CNN Week 7 –Squatter Removal Passes House, Budget Talks, and Lake Martin Boating Bill Advances

April 9, 2024

The 2024 legislative session is almost one third complete. Last week, the legislature used two legislative days and held Wednesday as a committee day, leaving 11 of 30 legislative days and 6 calendar weeks remaining. Over 700 bills have been filed including last week’s 90 new bills. In big news from the seventh week, the budgets started moving out of committees and the House passed a number of bills of REALTOR® interest, including a bill setting a process for removing squatters. Continue reading for highlights from week 7!

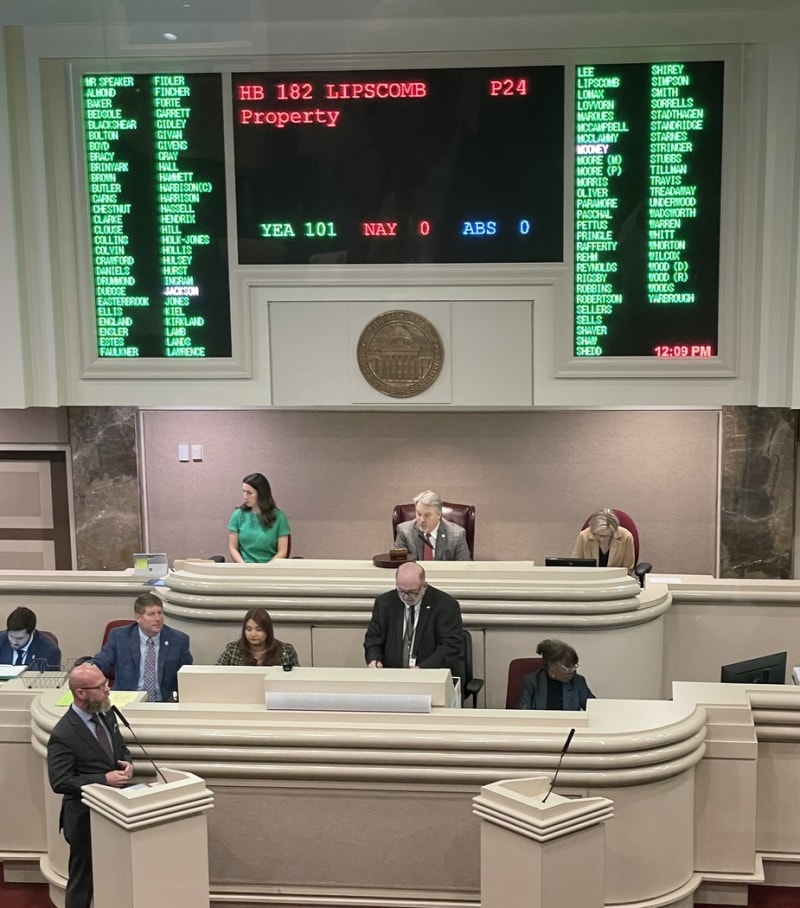

REALTOR®-Supported Squatter Removal Bill Passes House Unanimously

HB 182 passed the House on Thursday. Sponsored and carried on the House floor by Rep. Craig Lipscomb (R-Gadsden), the bill would set a more efficient process for homeowners to remove squatters. Squatting has become a nationwide issue, with surrounding states like Florida and Georgia passing laws just recently. While squatting in Alabama has not received the attention of these other states, the problem is present in Alabama, and Alabama REALTORS® support the bill as a proactive approach before the issue spreads.

The bill is not intended to replace emergency situations, where intruders break in – the homeowner should call 911 and report the intrusion. HB 182 comes into play when the intruder refuses to leave and law enforcement may not feel comfortable removing the squatter because the squatter falsely claims it is their house or the squatter presents a fraudulent lease. HB 182 would enable the squatter’s removal without going through a lengthy and costly ejectment action in the courts. HB 182 establishes an affidavit for homeowners or their agents to sign and submit to law enforcement, establishing their ownership or agency and asserting that an individual or individuals are in the house, received notice to leave, and refuse to leave. The bill also makes clear that squatting is a crime and increases the penalty for squatters who cause over $1000 in damage to the dwelling.

The bill protects legitimate occupants by prohibiting use for tenants and holdover tenants, as well as family members, and creating a civil cause of action for and criminalizing as perjury the filling out of a false affidavit.

The bill passed the House by a vote of 101-0, and over 80 representatives signed on to be co-sponsors, a sure sign of widespread, bi-partisan support. Alabama REALTORS® appreciates the legislators who spoke in favor of the bill on the floor – Reps. Prince Chestnut (D-Selma), Steve Clouse (R-Ozark), Juandalynn Givan (D-Birmingham), Barbara Drummond (D-Mobile), Arnold Mooney (R-Birmingham), Patrick Sellers (D-Birmingham), and Mark Shirey (R-Mobile).

The bill now goes to the Senate.

Bill Limiting Wakes at Lake Martin and Weiss Lake Passes House

The House passed one bill that increases safety measures at Lake Martin. HB 209, sponsored by Rep. Ed Oliver (R-Dadeville), would limit how close someone can wake board or wake surf near the shoreline or dock. When the boats used for wake boarding and wake surfing are in use, they cast off massive wakes, increasing erosion issues, damaging property like docks and even seawalls over time, and creating safety issues for swimmers, especially children near the shore.

A 2023 act limited how close wake board and wake surf boats could get to shore while being used for wake boarding or surfing but only applied to Smith Lake, Lake Wedowee, and Shoal Creek. HB 209 adds Lake Martin to the list and, for these water bodies, also limits to 100 feet from shore or a dock the distance any boat can operate above idle speed.

The bill was amended on the floor by Rep. Cynthia Almond (R-Tuscaloosa) to add Weiss Lake to the protected lakes.

Short-term Rental Lodging Tax Collection Bill – REALTOR® Amendment Added

Companion bills passed both chambers of origin last week that would require short-term rental operators, like VRBO, to collect and remit lodgings taxes. In both chambers, Alabama REALTORS® successfully advocated for an amendment to exempt property managers who manage and rent primary residences for a month or more. We appreciate sponsors Rep. Corley Ellis (R-Columbiana) and Sen. Garlan Gudger (R-Cullman) for their willingness to address REALTOR® concerns.

Several Workforce Development Bills Advance

As reported two weeks ago, Gov. Kay Ivey, Lt. Gov. Will Ainsworth and legislative leadership announced a seven-bill package for workforce development. Several of those bills dealing with innovation districts advanced last week.

Reps. Neill Rafferty (D-Birmingham) and James Lomax (R–Huntsville) each presented bills on innovation districts, which are defined economic development areas that cluster entrepreneurs, medical research institutions, start-ups, and similar business entities. Senate companion bills were also in committee and are carried by Sens. Dan Roberts (R-Birmingham) and Bobby Singleton (D-Greensboro).

HB 368 and SB 243 is a constitutional amendment that seeks to enable the use of public funds for these districts, while HB 349 and SB 242 aims to exempt the districts from certain fees and taxes.

All four bills received favorable reports from the committees in the bills house of origin. An amendment was adopted by the committee on HB 349 and SB 242, stripping out language giving the district eminent domain powers.

Budgets Receive Attention

The 2025 General Fund and Education budgets and 2024 supplemental bills both came up in committees last week. In the House Ways and Means Education committee, the education budget was presented by Rep. Danny Garrett (R-Trussville), who chairs the committee.

Garrett said the budget would closely mirror the suggested spending plan submitted by Gov. Kay Ivey at the beginning of the session, but he noted that slight changes, such as increased funding for higher education, would likely result. Both Ivey and Garrett support a 2% pay raise for teachers and public education personnel.

A separate bill would allocate $651.2 million in excess revenues that the ETF generated above predicted estimates during the last fiscal year. The supplemental appropriation directs $51 million to start the recently approved school choice law that will allow some families to receive tax credits when attending private schools; provides $7 million for charter school capital improvement grants; and funds the hiring of 200 assistant principals in middle and high schools.

Garrett also suggested passage of a one-time $1 billion appropriation from the state’s Advancement and Technology Fund, which can be used pay for capital projects, security improvements and technology upgrades in K-12 schools, colleges, and universities.

Both education budget bills are expected in committee this week.

The General Fund budget and supplemental bill were presented by Sen. Greg Albritton (R-Atmore) to the Senate Finance Taxation, General Fund committee. As described by Sen. Albritton, the General Fund budget has minor differences from the governor’s proposed budget, with a few larger items like $5 million to the Mobile Airport Authority and $5 million for pier upgrades to the Port. In the 2024 supplemental, a few changes include $20 million for a parking deck at the new state house, additional money for the Department of Mental Health’s Taylor Hardin Facility, and prison construction funding increased by $100 million to $150 million. As a reminder, supplemental budget bills are for the current fiscal year and appropriate funds received in excess of those estimated and appropriated during the prior legislative session.

Both bills passed out of Senate committee with little discussion.

Corporate Annual Reporting Bill Nearing Final Passage

A bill deleting a redundant reporting requirement for corporations has one step before final passage. HB 230, by Rep. Margie Wilcox (R-Mobile), deletes a requirement that corporations submit an annual report to the Secretary of State’s office. Supported by Alabama REALTORS® as a common sense reduction in red tape on Alabama’s businesses, the bill passed Senate committee and is ready for consideration by the full Senate.

Sen. David Sessions (R-Grand Bay) is carrying the bill in the Senate.

Proposed Tax Credit for Storm Shelters

Rep. Joe Lovvorn (R-Auburn) presented HB 380, renewing a tax credit of up to $3,000 for storm shelter construction until 2028.

Lovvorn, who passed the original legislation, is a retired firefighter who was deeply involved in rescue efforts following a 2019 tornado that killed two dozen people in Lee County.

The bill received a favorable report from the House Ways and Means Education Committee and is pending consideration on the House floor.

Asbestos Exposure Civil Action Reform Moves Through Senate

The Alabama Senate unanimously approved on Thursday a bill by Sen. Josh Carnley (R–Enterprise) that establishes guidelines for disclosing information in civil cases concerning asbestos exposure.

The legislation mandates that plaintiffs must furnish comprehensive details about their asbestos exposure claims, including a comprehensive list of past and present workplaces and all individuals with knowledge of the alleged exposure.

Following its 32 - 0 vote, SB 104 now proceeds to the Alabama House, where it is being carried by Rep. Troy Stubbs (R-Wetumpka).

Alabama Adventure Awaits Sales Tax Holiday

Rep. Joe Lovvorn (R-Auburn) proposed HB 257, establishing a twice-yearly Alabama Adventure Awaits sales tax holiday, exempting specific outdoor recreational items from sales tax on the first weekends of March and August.

The proposal is similar to Florida’s Freedom Summer sales tax holiday and would apply to items that include boating supplies like life vests, water skis, and kayaks; camping gear like tents and sleeping bags; a wide array of fishing gear; general outdoor supplies that range from sunglasses to binoculars to bicycles, and others.

The bill garnered a favorable report from the House Ways and Means Education committee.